Empower Your Business: Bagley Risk Management Insights

Empower Your Business: Bagley Risk Management Insights

Blog Article

How Livestock Threat Security (LRP) Insurance Can Protect Your Animals Investment

Animals Threat Defense (LRP) insurance coverage stands as a reputable guard versus the unforeseeable nature of the market, offering a calculated approach to safeguarding your assets. By delving into the intricacies of LRP insurance coverage and its diverse advantages, livestock producers can strengthen their financial investments with a layer of safety that goes beyond market variations.

Comprehending Livestock Danger Protection (LRP) Insurance

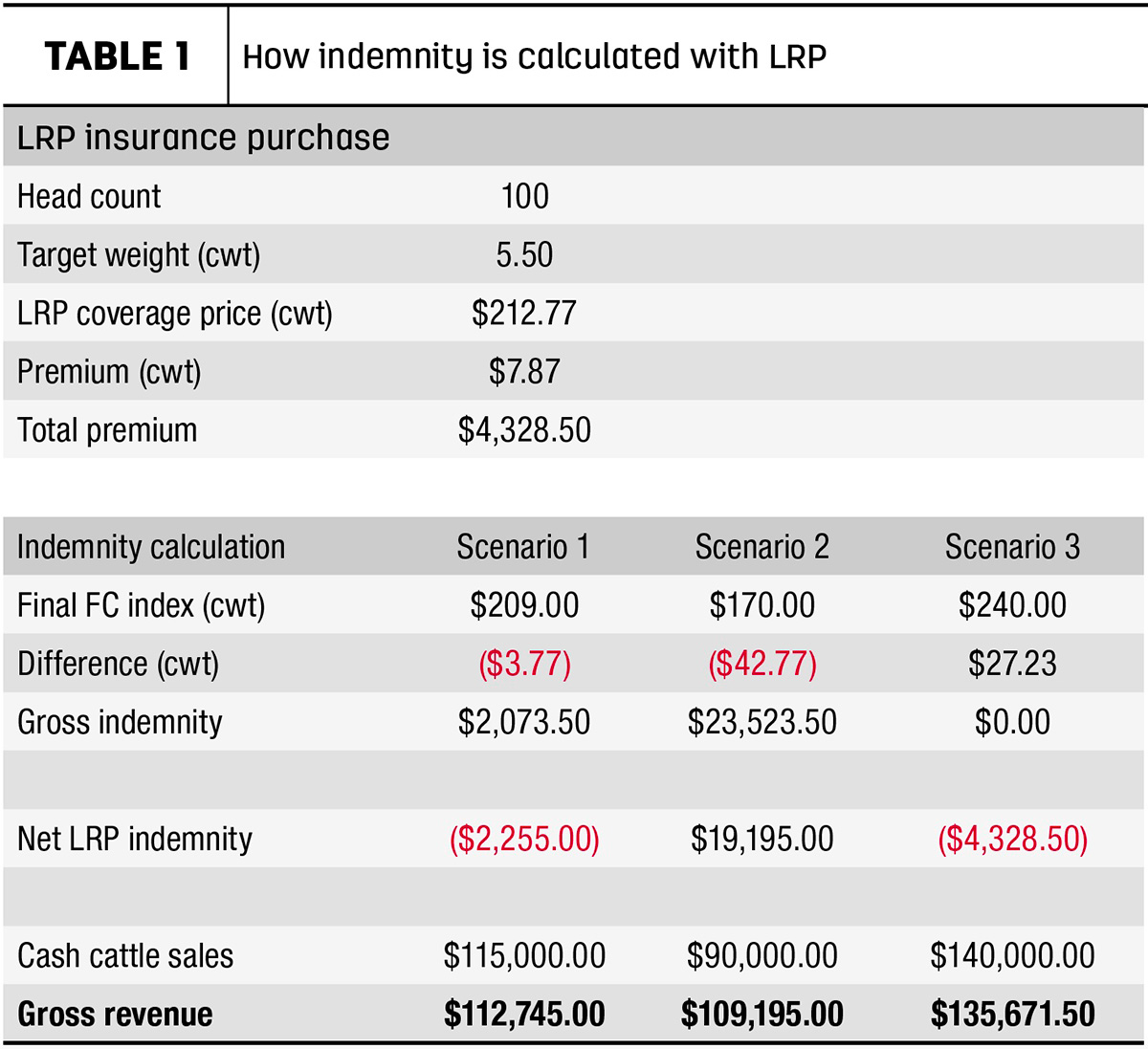

Understanding Animals Danger Defense (LRP) Insurance coverage is important for livestock manufacturers seeking to reduce financial risks connected with cost fluctuations. LRP is a government subsidized insurance coverage item developed to shield producers against a decline in market prices. By giving insurance coverage for market rate declines, LRP helps producers secure a floor cost for their livestock, guaranteeing a minimal level of profits no matter market variations.

One trick element of LRP is its adaptability, allowing producers to customize protection degrees and plan lengths to fit their specific needs. Producers can pick the number of head, weight variety, coverage price, and protection duration that align with their manufacturing goals and take the chance of resistance. Recognizing these personalized options is vital for producers to properly handle their cost threat direct exposure.

Additionally, LRP is available for numerous livestock types, consisting of livestock, swine, and lamb, making it a flexible danger administration tool for animals manufacturers across various sectors. Bagley Risk Management. By familiarizing themselves with the complexities of LRP, producers can make enlightened choices to guard their financial investments and guarantee financial security when faced with market uncertainties

Benefits of LRP Insurance Policy for Animals Producers

Animals manufacturers leveraging Livestock Threat Defense (LRP) Insurance policy obtain a strategic advantage in securing their financial investments from cost volatility and securing a steady monetary footing in the middle of market uncertainties. By setting a floor on the rate of their livestock, producers can minimize the danger of significant monetary losses in the occasion of market slumps.

In Addition, LRP Insurance policy gives manufacturers with tranquility of mind. Overall, the benefits of LRP Insurance for livestock producers are substantial, using a valuable device for managing threat and making certain economic safety in an unforeseeable market setting.

How LRP Insurance Policy Mitigates Market Dangers

Minimizing market risks, Livestock Danger Security (LRP) Insurance policy gives livestock manufacturers with a reputable shield versus cost volatility and monetary uncertainties. By using defense against unexpected price decreases, LRP Insurance policy aids producers safeguard their investments and preserve economic security in the face of market variations. This kind of insurance policy allows livestock producers to secure a price for their pets at the start of the policy duration, ensuring a minimum rate degree despite market adjustments.

Steps to Secure Your Livestock Financial Investment With LRP

In the realm of farming threat management, applying Livestock Threat Security (LRP) Insurance entails a critical procedure to protect financial investments versus market fluctuations and uncertainties. To safeguard your animals financial investment efficiently with LRP, the initial step is to evaluate the details risks your procedure encounters, such as rate volatility or unexpected weather condition occasions. Next, it is essential to study and pick a trusted insurance policy supplier that provides LRP plans customized to your animals and company requirements.

Long-Term Financial Security With LRP Insurance

Making certain withstanding economic security via the utilization of Animals Threat Protection (LRP) Insurance policy is a prudent long-term technique for farming manufacturers. By integrating LRP Insurance right into their threat management plans, farmers can protect their animals financial investments versus unexpected market fluctuations and unfavorable occasions that could endanger their economic well-being gradually.

One secret benefit of LRP Insurance policy for long-term monetary security is the comfort it supplies. With a reputable insurance plan in position, farmers can minimize the economic dangers linked with volatile market conditions and unanticipated losses due to variables such as condition outbreaks or all-natural disasters - Bagley Risk Management. This stability enables producers to concentrate on the daily operations of their animals business without constant worry concerning prospective economic obstacles

In Addition, LRP Insurance coverage gives a structured technique to handling threat over the long-term. By setting certain insurance coverage degrees and choosing appropriate recommendation durations, farmers can tailor their insurance coverage prepares to straighten with their economic goals and take the chance of resistance, guaranteeing a safe and lasting future for their animals procedures. Finally, purchasing LRP Insurance policy is a proactive strategy for farming producers to achieve long lasting monetary protection and protect their source of incomes.

Verdict

Finally, Livestock Threat Defense (LRP) Insurance is a useful tool about his for animals producers to alleviate market threats and safeguard their investments. By comprehending the benefits of LRP insurance coverage and taking steps to implement it, manufacturers can achieve lasting monetary safety for their procedures. LRP insurance policy provides a safeguard against cost fluctuations and ensures a degree of security in an unpredictable market atmosphere. It is a sensible selection for protecting animals investments.

Report this page